Streamlined Payment Approval Process: A Complete Guide

Payment Approval Process: Who Makes the Final Call on Questionable Transactions? A well-structured payment approval process can cut invoice errors by 50% and save finance teams up to 4 days at month-end. This critical business function plays an essential role in protecting organizations from financial risks and inefficiencies in today’s accounts payable landscape.

However, without robust safeguards, businesses remain vulnerable to unauthorized transactions, fraudulent activities, and costly errors. Additionally, delays frequently occur when approvers are unavailable or requests become stuck in lengthy reviews. The payment authorization process creates an extra layer of security and control over financial transactions while increasing transparency throughout the accounts payable approval workflow.

This guide examines who holds final decision-making authority for questionable transactions, how payment controls should be structured, and practical steps to implement an effective payment approval workflow that balances efficiency with proper oversight.

Understanding the Payment Approval Workflow

The payment approval process forms the backbone of financial operations in modern organizations. Unlike traditional methods where invoices were simply received and paid, today’s businesses require structured controls to manage their financial transactions effectively.

What is the payment approval process?

The payment approval process represents a systematic series of steps businesses follow to review and authorize payments for invoices before funds are released to vendors or contractors. This workflow begins when a supplier submits an invoice and concludes with the execution of payment after proper verification and authorization.

At its core, the payment approval workflow serves as a control mechanism that verifies three critical elements:

- The right payment amount is being processed

- The payment is directed to the legitimate vendor

- The transaction occurs at the appropriate time

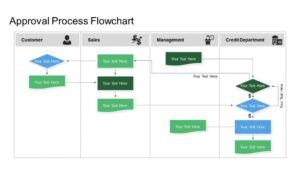

Most approval workflows include these essential stages:

- Invoice receipt and verification – Capturing invoice details and ensuring completeness

- Matching – Comparing invoices against purchase orders and delivery receipts

- Approval routing – Directing the invoice to designated approvers based on predefined criteria

- Review and authorization – Verification by appropriate stakeholders

- Payment scheduling – Processing the payment according to terms

- Recording – Creating an audit trail for future reference

Depending on organizational needs, these processes may operate manually through physical paperwork or through automated systems with electronic approvals. Many businesses are shifting toward automation, as manual processing of invoices takes approximately 12 minutes before even reaching the approver.

Why it matters for financial control and compliance

The payment approval process delivers substantial benefits beyond simply paying bills. First and foremost, it acts as a fraud prevention mechanism. Through verification steps like three-way matching, businesses can stop unauthorized payments for goods or services never received.

Furthermore, proper payment controls are essential for maintaining regulatory compliance. Organizations must adhere to various standards including:

- PCI-DSS compliance for secure card payment handling

- ACH and wire transfer regulations requiring proper authentication

- SOX compliance ensuring accurate financial reporting

Consequently, businesses implementing robust approval workflows reduce significant financial risks. Companies that have adopted automated approval systems can potentially reduce costs by nearly 50% through eliminating paper-based processes.

Beyond cost savings, effective payment approval processes directly impact operational efficiency. Without structured workflows, organizations face common challenges:

- Delayed approvals resulting in missed early payment discounts

- Poor visibility into payables and vendor obligations

- Damaged vendor relationships due to late or inaccurate payments

- Increased vulnerability to errors and fraud

The payment approval process specifically reinforces vendor compliance with organizational policies and contract terms. Automated compliance checks ensure invoices match purchase orders, contracts, and goods receipts—significantly reducing payment errors and fraud risks.

In essence, the payment approval workflow represents a critical business function that maintains financial integrity while facilitating timely payments. As transaction volumes grow, so do the associated risks—making structured approval processes increasingly essential for organizations of all sizes.

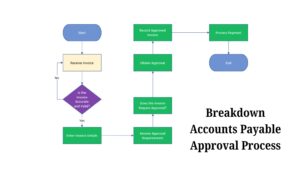

Step-by-Step Breakdown of the Accounts Payable Approval Process

Examining the mechanics of an effective accounts payable workflow reveals how organizations systematically validate and process payments. A well-designed approval sequence prevents errors and fraud while ensuring timely vendor payments. Let’s break down this crucial process into its fundamental stages.

1. Invoice receipt and verification

Initially, the accounts payable process begins when vendors submit invoices through various channels – email, postal mail, or electronic platforms. Upon arrival, these documents undergo preliminary examination for completeness and accuracy. Finance teams review basic elements including vendor details, invoice date, invoice number, and descriptions of goods or services provided.

Following this initial review, the verification stage implements a critical control mechanism known as three-way matching. This process cross-references invoice details against corresponding purchase orders and delivery receipts to confirm that what was ordered matches what was received and billed. Essentially, this verification prevents payment for goods never delivered or services never rendered.

Modern invoice processing systems employ optical character recognition (OCR) technology to extract information automatically, converting paper-based documents into standardized digital formats for processing. This technology significantly reduces manual data entry requirements, minimizing human error potential throughout the verification process.

2. Expense coding and routing

Subsequently, approved invoices undergo coding – a pivotal step where each line item receives appropriate general ledger (GL) accounts, cost centers, and department codes. This categorization ensures expenses are properly allocated within the organization’s financial structure.

The coding process differs based on whether invoices reference purchase orders. PO-based invoices typically follow an automated path where coding details from the original purchase order are automatically applied to the invoice. Conversely, non-PO invoices require more manual judgment to determine appropriate expense categories and departmental allocations.

Following coding, the routing system directs invoices to designated approvers based on predefined rules. These might include department ownership, vendor relationships, or spending thresholds. Advanced AP systems use business rules to automatically route documents, sending notifications to approvers and establishing due dates for review.

3. Multi-level approval based on thresholds

Throughout the approval workflow, invoices typically pass through multiple levels of authorization before payment authorization. This multi-tiered approach strengthens financial control and reduces fraud risk by requiring sequential sign-offs from various stakeholders.

Most organizations establish approval thresholds that determine how many approvals are required based on specific criteria:

- Invoice amount (higher values require additional approvals)

- Expense type (capital expenditures vs. operational expenses)

- Department or business unit

- Vendor category or risk profile

Notably, finance experts recommend implementing at least two distinct levels of approval for enhanced security. Moreover, separating invoice and payment approvals among different personnel creates a dual verification system that further protects company funds.

4. Payment scheduling and execution

Once approved, invoices move to payment scheduling where finance teams determine optimal timing based on several factors. These include vendor payment terms, cash flow considerations, and potential early payment discounts. For instance, taking advantage of terms like “1% Net 10” can generate significant savings through prompt payments.

During this stage, the system selects the appropriate payment method – ACH transfers, checks, wire transfers, or credit cards – based on vendor preferences and company policies. Automated AP systems can schedule and execute these payments with minimal manual intervention, optimizing working capital management.

Payment execution involves transmitting funds to vendors through the selected method while documenting transaction details. Modern systems create payment batches that streamline this process, particularly for organizations processing high transaction volumes.

5. Recording and audit trail creation

The final crucial component involves comprehensive documentation throughout the entire workflow. Each action – from initial receipt through final payment – generates entries in the audit trail, creating a chronological record that identifies who did what and when.

This audit trail serves multiple essential functions. Primarily, it establishes accountability by tracking approvals and modifications. It also supports compliance with internal policies and external regulations by providing evidence that proper controls were followed.

Furthermore, this documentation facilitates error correction by offering a historical record that helps identify when and where issues occurred. For organizations undergoing internal or external audits, a complete audit trail simplifies the review process and demonstrates financial control integrity.

Ultimately, this systematic approach to documentation creates transparency throughout the accounts payable process, supporting both operational efficiency and financial governance requirements.

Who Makes the Final Call on Questionable Transactions?

When questionable transactions arise within a payment approval workflow, clear decision-making authority becomes vital. Understanding exactly who holds final approval rights helps organizations maintain financial control while resolving potentially problematic payments efficiently.

Role of department heads and finance managers

Department heads serve as the first line of authority in the payment approval process, delegating specific transaction approval rights to individuals within their units. These designated approvers must have authority levels appropriate to their experience, knowledge, and position within the organization. Although approval tasks can be delegated, department heads retain ultimate accountability for financial transactions within their domain.

Finance Managers play a critical role in overseeing day-to-day financial operations, including budgeting, accounting, and compliance activities. They typically verify that transactions comply with organizational policies and legal requirements before authorization. Finance Managers generally review documentation for completeness and look for potential policy violations before transactions proceed to payment.

Escalation to CFO or executive team

Transactions flagged as questionable frequently require escalation beyond department-level approvers. In cases involving significant amounts or unusual circumstances, the decision-making authority typically shifts to senior executives. From time to time, organizations utilize specialized committees for final decision-making on suspicious transactions.

In fact, many organizations establish clear escalation paths that lead to the Chief Financial Officer or executive team when transaction irregularities are detected. The decision-maker, whether an individual or committee, must have sufficient authority to make the final determination on suspicious transaction reports.

When legal or compliance teams get involved

Primarily, legal counsel becomes involved when transactions might expose the organization to significant risk. The Office of General Counsel typically advises on legal aspects of contractual transactions and provides guidance on questionable payments.

Compliance teams—especially in regulated industries—play a crucial role in suspicious transaction review. The compliance investigation team and Money Laundering Reporting Officer (MLRO) conduct appropriate transaction investigations and share findings with senior management. After thorough review, the Compliance Head presents reports to the Compliance Committee, which ultimately decides whether to file suspicious transaction reports with regulators.

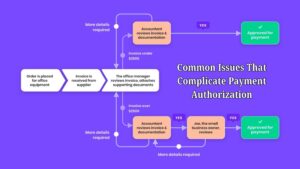

Common Issues That Complicate Payment Authorization

Even the most carefully designed payment approval workflows face operational hurdles that can derail efficiency and increase risk. Organizations routinely encounter several persistent challenges that complicate their payment authorization processes.

Unclear approval rules

Ineffective governance starts with ambiguous approval hierarchies and inconsistent standards. Without standardized workflows, organizations struggle to maintain control over how invoice data is entered and validated. This lack of clarity often stems from decentralized systems where different departments process invoices independently, creating inconsistencies in how transactions are recorded and approved. Consequently, organizations with fragmented approval structures experience higher error rates and compliance vulnerabilities.

Manual bottlenecks and delays

Paper-based or email-driven approval workflows create significant operational friction. With manual routing, invoices frequently get buried in inboxes or remain untouched when key approvers are unavailable. These bottlenecks extend payment cycles, strain vendor relationships, and potentially disrupt supply chains. In fact, studies reveal that 81% of suppliers report receiving late payments due to approval delays. Additionally, manual data entry processes introduce “fat-finger” errors that can trigger undetected payment duplications.

Lack of visibility into payment status

Without centralized tracking systems, finance teams operate with limited insight into where invoices stand in the approval pipeline. This opacity makes identifying bottlenecks nearly impossible and complicates cash flow management. The absence of real-time payment insights leaves businesses struggling to predict incoming and outgoing payments, potentially leading to unnecessary credit usage and P&L imbalances. Furthermore, this visibility gap creates reconciliation challenges that extend days payable outstanding and increase operational costs.

Fraud risks and duplicate payments

The financial impact of payment errors can be substantial. Research indicates that between 1% and 2.5% of total disbursements processed annually are duplicated or erroneous. These costly mistakes frequently result from poor recordkeeping, inadequate controls, and undisciplined processes. Beyond unintentional errors, payment systems face deliberate fraud attempts. External actors may submit altered invoices with minor changes to trigger second payments, while internal schemes might involve employees creating fake invoices or colluding with vendors.

How to Strengthen Your Payment Approval Workflow

Modernizing payment workflows requires strategic improvements that balance security with operational efficiency. Businesses looking to enhance their payment approval systems can implement several proven strategies.

Use of AP automation tools

Automating accounts payable processes drastically reduces manual work while minimizing human error. Organizations implementing automation tools can process payments up to 3 times faster than traditional methods. Through AI-powered invoice processing, these systems accurately capture invoice details, match them to purchase orders, and route documents to appropriate approvers—all without manual intervention. Remarkably, companies that adopt automated approval systems can decrease costs by nearly 80% by eliminating paper-based processes.

Setting clear approval thresholds

Establishing customizable approval policies based on transaction values creates appropriate oversight without unnecessary bottlenecks. Organizations should configure their approval hierarchies around specific dollar thresholds, ensuring higher-value transactions receive additional scrutiny. Furthermore, implementing dual control requirements for certain payment types provides an extra layer of fraud protection. Limit-based approvals streamline workflows by routing transactions directly to approvers with appropriate signing authority based on predefined thresholds.

Real-time tracking and alerts

Visibility throughout the approval process remains crucial for operational control. Advanced systems allow stakeholders to check approval status anytime and automatically route notifications to designated personnel when approvals are pending or overdue. Mobile approval capabilities enable authorized users to verify and accept payment requests from anywhere, preventing delays when key decision-makers are away from their desks.

Integrating with ERP systems

Connecting payment approval workflows with enterprise resource planning systems creates a unified financial ecosystem. These integrations enable automated reconciliation, matching payments with invoices for more accurate financial records. Through real-time data synchronization, processed payments immediately appear in financial reports, improving cash flow visibility and forecasting capabilities. Additionally, ERP integration enables centralized financial management where all payment data flows seamlessly between systems—reducing administrative burden while strengthening compliance controls.

Conclusion

Effective payment approval processes serve as the cornerstone of financial integrity for modern organizations. Throughout this guide, we examined how structured workflows protect businesses from fraud while ensuring timely vendor payments. Additionally, the multi-tiered approval approach based on predefined thresholds creates essential safeguards against unauthorized transactions.

Organizations must recognize that questionable transactions require clear decision-making authority. Department heads, finance managers, CFOs, and sometimes legal teams all play crucial roles within this framework. Without established escalation paths, businesses remain vulnerable to financial risks and compliance issues.

Most companies struggle with unclear approval rules, manual bottlenecks, limited visibility, and fraud risks. These challenges underscore the need for systematic improvements. Accordingly, businesses should consider implementing AP automation tools that process payments up to three times faster than traditional methods. Setting clear approval thresholds likewise ensures appropriate oversight without creating unnecessary delays.

Real-time tracking capabilities provide stakeholders with immediate visibility into payment status, eliminating the opacity that complicates cash flow management. Furthermore, ERP integration creates a unified financial ecosystem where payment data flows seamlessly between systems.

The payment approval process ultimately balances two competing priorities: maintaining strong financial controls while ensuring operational efficiency. Companies that successfully navigate this balance protect themselves from fraud and errors while fostering positive vendor relationships. Undoubtedly, businesses that invest in strengthening their payment authorization workflows position themselves for long-term financial stability and operational excellence.

Key Takeaways

Understanding who holds final authority over questionable transactions and implementing robust payment controls can protect your organization from fraud while maintaining operational efficiency.

- Multi-level approval hierarchy is essential: Department heads handle routine approvals, while CFOs and executive teams make final calls on questionable transactions exceeding predefined thresholds.

- Automation cuts processing time by 3x: AP automation tools reduce manual errors, process payments faster, and can decrease costs by up to 80% compared to paper-based systems.

- Three-way matching prevents fraud: Verifying invoices against purchase orders and delivery receipts stops unauthorized payments for goods never received or services never rendered.

- Clear approval thresholds streamline workflows: Setting dollar-based approval limits ensures appropriate oversight without creating unnecessary bottlenecks in the payment process.

- Real-time visibility eliminates payment delays: Tracking systems and mobile approval capabilities prevent invoices from getting stuck when key approvers are unavailable.

Organizations that balance strong financial controls with operational efficiency through structured payment approval workflows protect themselves from the 1-2.5% of annual disbursements typically lost to duplicate payments and fraud while maintaining positive vendor relationships.

FAQs

Q1. What are the key steps in a typical payment approval process?

A typical payment approval process includes invoice receipt and verification, expense coding and routing, multi-level approval based on thresholds, payment scheduling and execution, and recording for audit trail creation. This systematic approach ensures proper financial control and compliance.

Q2. Who has the final authority on questionable transactions?

The final authority on questionable transactions typically escalates to senior executives, such as the CFO or executive team. For complex cases, specialized committees may be involved. Legal and compliance teams also play crucial roles in reviewing high-risk transactions.

Q3. How can organizations strengthen their payment approval workflow?

Organizations can strengthen their payment approval workflow by implementing AP automation tools, setting clear approval thresholds, using real-time tracking and alerts, and integrating with ERP systems. These measures can significantly improve efficiency and reduce errors.

Q4. What are common issues that complicate the payment authorization process?

Common issues include unclear approval rules, manual bottlenecks causing delays, lack of visibility into payment status, and increased fraud risks. These challenges can lead to operational inefficiencies and financial vulnerabilities if not properly addressed.

Q5. How does automation impact the payment approval process?

Automation in the payment approval process can drastically reduce manual work and minimize human error. It enables businesses to process payments up to three times faster than traditional methods and can decrease costs by nearly 80% by eliminating paper-based processes.

Also Read: IAS Aspirants Who Cleared UPSC in First Attempt Without Coaching